Exploring the impact of the EU sustainability reporting landscape on companies in Asia

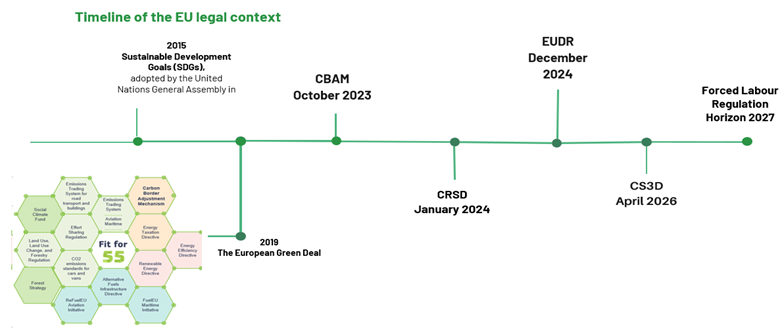

The European Union (“EU”) has been a driving force in environmental, social and governance (“ESG”) regulations. The EU’s environmental policies are part of a broader commitment to the Sustainable Development Goals (“SDGs”), adopted by the United Nations General Assembly[1] in 2015. These goals address critical global challenges such as climate change, environmental degradation, and social inequality.

In 2019, the EU announced the European Green Deal, setting an ambitious target of achieving zero net greenhouse gas (“GHG”) emissions by 2050. This initiative underscores the EU’s dedication to becoming the world’s first climate-neutral continent.

To support this goal, the EU has implemented a series of regulatory measures designed to promote sustainability and mitigate the impacts of climate change, including:

- the Directive 2022/2464 on corporate sustainability reporting (“CRSD”),

- the Regulation (EU) 2023/1115 on the making available on the Union market and the export from the Union of certain commodities and products associated with deforestation and forest degradation (“EUDR”),

- the Regulation (EU) 2023/956 establishing a carbon border adjustment mechanism (“CBAM”),

- the proposed Regulation (EU) on prohibiting products made with forced labour on the Union market (“Forced Labor Regulation”).

Together, these initiatives seek to drive a more sustainable economy by ensuring that companies adhere to stringent environmental standards and provide clear, reliable information to investors and consumers.

While these regulations are EU-driven, their impact extends globally. Companies worldwide that wish to do business in the EU or with EU-based companies must adapt to these standards. This requirement to adopt the EU standards has a cascading effect, pushing global supply chains towards greater sustainability and ethical practices.

The ASEAN Taxonomy Board (“ATB”), set up under the auspices of the ASEAN Finance Ministers and Central Bank Governors’ Meeting also participates to the creation of ESG guidelines by developing, maintaining and promoting a multi-tiered guide on ASEAN Taxonomy for Sustainable Finance (“ASEAN Taxonomy”) which identifies economic activities that are sustainable and help direct investment and funding towards a sustainable ASEAN.

The ASEAN Taxonomy (Version 3 published on 27 March 2024) is an overarching guide for all ASEAN Member States (“AMS”), complementing their respective national sustainability initiatives and serving as ASEAN’s common language for sustainable finance. It is designed to ensure that AMS have a framework that suits their economic and social structures that other frameworks may not be able to address.

In this newsletter, we aim to provide:

- a better understanding of the EU’s sustainability reporting landscape;

- how it compares to five key Asian jurisdictions: China, Indonesia, India, Vietnam and Singapore; and

- steps to take to comply with the new EU regulations.

I. Understanding the EU’s sustainability reporting landscape

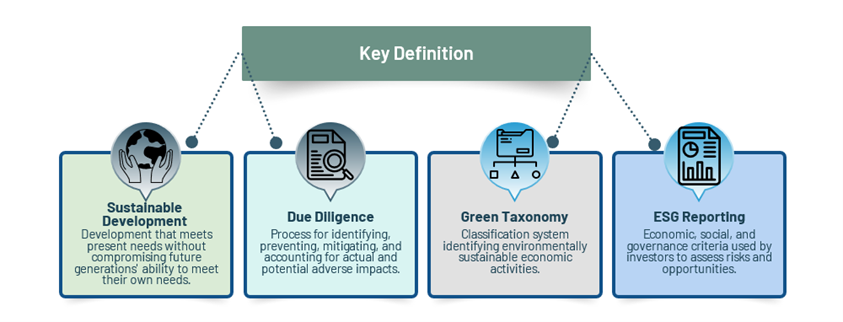

1. Key definitions and timeline

A. Key Definitions

2. Timeline of the EU legal context

3. CSRD

The CSRD is a critical part of the EU’s environmental strategy. It replaces Directive 2014/95 on disclosure of non-financial and diversity information by certain large undertakings and groups (“NFRD”) and aims to enhance the reliability and accessibility of sustainability information through standardized and comprehensive reporting. Since 1st January 2024, the CSRD mandates companies that meet certain thresholds to report on Environmental, Social, and Governance (ESG) criteria, integrating sustainable finance and green taxonomy principles. It introduces the concept of “dual materiality,” ensuring that companies report on how sustainability issues affect them and their impact on society and the environment. This standardized reporting aims to improve the reliability and transparency of sustainability data, guiding investors, and stakeholders towards more informed decisions.

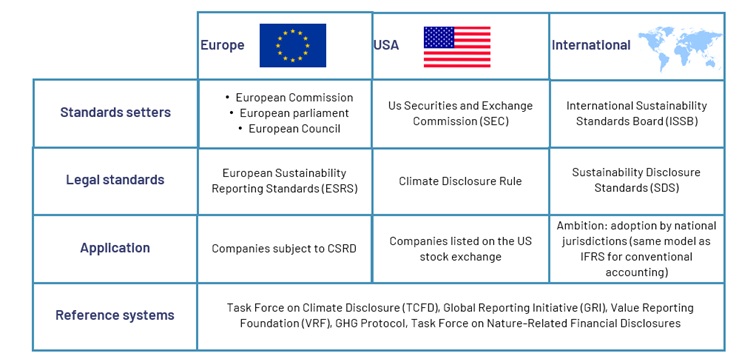

A. Comparison with other international initiatives

In comparison with the other international regulations, the CSRD can be considered as the most ambitious of the ESG information standardisation initiatives.

B. Scope of application and road map

CSRD will be implemented in phases as illustrated below:

| Large Public Interest Entities (PIEs) with >500 Employees (Already Subject to NFRD): | Large Companies Newly Subject to CSRD (Including Large Listed Companies with < 500 Employees): | Listed Small and Medium-Sized Enterprises (SMEs): | Non-European Companies Meeting CSRD Conditions: |

| 2024 – Immediate Action: Begin preparing for CSRD compliance based on cross-sector standards. | 2024/2025 – Preparation Phase: Prepare for CSRD compliance based on cross-sector standards. | 2026/2028 – Preparation and Transition Phase : Prepare for CSRD compliance based on specific ESRS standards. | 2028-Preparation Phase : Prepare for CSRD compliance based on specific ESRS standards. |

| Key Steps: Assess current sustainability reporting and identify gaps.Update internal processes for data collection and reporting.Allocate resources and designate teams for CSRD compliance.Engage with stakeholders to understand their expectations.Conduct a materiality analysis to identify key sustainability issues. Outcomes: Establish a CSRD compliance framework.Initiate data gathering and reporting activities. | Key Steps: Familiarize with CSRD requirements and guidelines.Conduct a gap analysis comparing current practices with CSRD requirements.Develop a roadmap and timeline for CSRD implementation.Enhance internal capacity for sustainability reporting.Consider engaging external experts for support. Outcomes: Gain a clear understanding of CSRD obligations.Begin internal preparations for compliance. | Key Steps: Monitor developments in ESRS standards and guidelines.Evaluate readiness for sustainability reporting.Implement changes to internal processes and systems.Train and support relevant staff members.Develop a communication strategy for stakeholder engagement. Outcomes: Align internal systems with CSRD requirements.Begin sustainability reporting activities | Key Steps: Understand CSRD requirements and implications for non-European companies.Assess operations and supply chains comprehensively.Collaborate with European subsidiaries or partners for data gathering.Develop strategies to address compliance challenges.Establish communication channels with regulatory authorities for guidance. Outcomes: Develop a CSRD compliance plan.Initiate necessary actions to meet requirements. |

C. Controls and penalties:

Statutory auditor or audit form must carry out the assurance of sustainability reporting. As most of the European regulations, each member state must ensure that the provisions of the directive are implemented by providing an effective, proportionate, and dissuasive sanction to auditors and audit firms.

3. CBAM

The CBAM aims to prevent carbon leakage by ensuring equivalent carbon pricing for imports and EU products. It gradually phases out free allowances under the EU Emissions Trading System (ETS) and introduces a carbon pricing mechanism for imports, ensuring that non-EU products are not favored over EU products. This mechanism supports the goal of climate neutrality and aligns with international climate commitments, such as the Glasgow Climate Pact and the Paris Agreement. These regulations aim to reduce the EU’s carbon footprint and promote sustainable economic activities that do not exacerbate climate change.

A. Scope of application:

The CBAM creates new regulatory obligations for importers and will initially apply only to the following sectors: cement, aluminum, nitrogen fertilizers, electricity and hydrogen.

The CBAM places the main liability on the EU importer, however the regulatory obligations will require concerns all economic operators and strong cooperation between producers or suppliers and buyers involved in the supply chain concerned in international trade from or to of products imported in the EU. The CBAM provides a transition phase and an effective operating period:

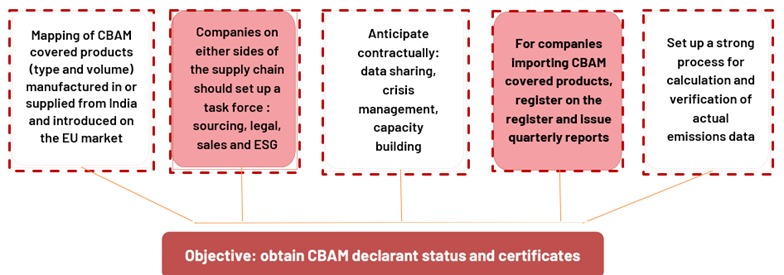

B. Obligations under CBAM

First, every importer of products covered by CBAM has to register on the CBAM register and issue quarterly reports until January 2026. Until this date, every importer will have to apply for authorized declarant status. Starting 2026, imports of CBAM products will need to be made with a CBAM certificate, whose price will be related to the carbon emissions embedded in the products imported, as calculated by the producer/supplier. From 2026, before 31st May of each year, authorized CBAM declarants will issue the CBAM register to submit a CBAM declaration for the previous calendar year.

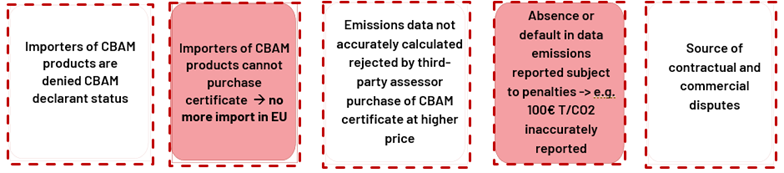

C. Effects of non-compliance

4. EUDR

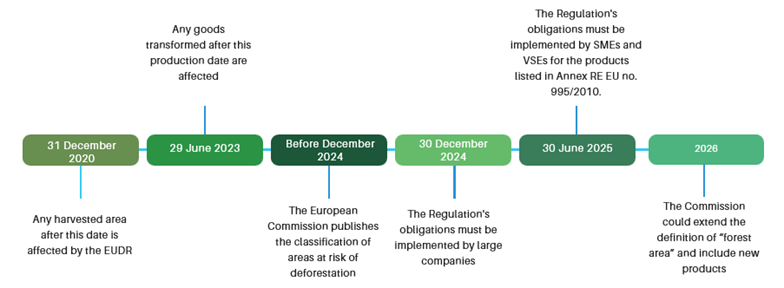

The EUDR aims to tackle global deforestation, a major contributor to climate change and biodiversity loss and imposes strict rules in terms of due diligence to all companies wishing to market affected products in the EU or to export them. The EUDR is part of the EU’s broader strategy to protect biodiversity, as reflected in its commitments under the Convention on Biological Diversity (CBD) and the European Green Deal. Companies have until 30 December 2024 to be compliant, except for micro and small undertakings for which the EUDR will apply from 30 June 2025.

A. Scope of application

The products concerned by the EUDR are those from the following sectors: cattle, rubber, wood, soya, cocoa, coffee and palm oil. They will only be authorised to be placed on the EU market or exported if they are deforestation-free, produced in accordance with relevant local legislation and covered by a due diligence statement. Any of those product’s export to the EU, found in the food, luxury or automobile industry, in any level of the value chain (not only raw product) are concerned except if they fall into the category of recycled basic and used products that would otherwise be disposed of as waste.

To prevent and dissuade potential deforestation resulting from anticipated acceleration in the activities causing deforestation, any production activity occurring after the 31 December 2020 will be affected. Concerning the transformed goods, this regulation will apply to any products for which the production date is prior to the 29 of June 2023 and 30 December 2024 for wood.

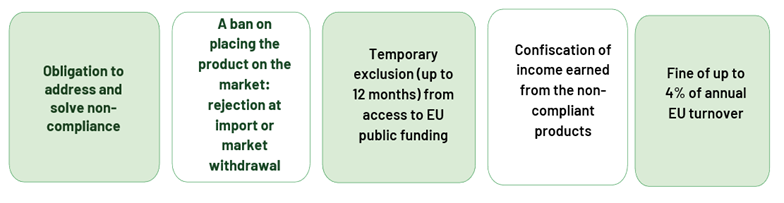

B. Corrective measure and penalties

In case of non-compliance, companies will have to address and solve the non-compliance and may face the following sanctions:

5. Forced Labor regulation

The Forced Labour Regulation aims at preventing products made with forced labor from entering the EU market, prohibiting the import of goods produced using forced labor, requiring companies to ensure their supply chains are free from forced labor and to provide transparency about their sourcing practices, and establishing mechanisms for monitoring and enforcing compliance, including inspections and penalties for violators. The Forced Labour Regulation goal is to combat forced labor globally by leveraging the EU’s market power to encourage ethical labor practices.

A. Scope of application

This regulation will apply to all products entering into the EU market and all parties (economic operator, producer, supplier, importer, etc.) on the supply chain are concerned.

B. Controls and sanctions

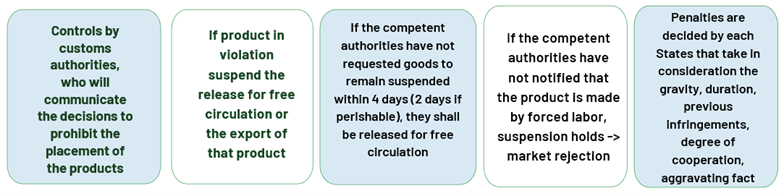

Compliance with the Forced Albor Regulations will be monitored by customs authorities and non-compliance will have the following consequences:

This new EU sustainability reporting landscape is part of a broader effort to promote sustainable development and address global environmental challenges, including in Asia. For several years, Asia has been undergoing significant developments: many nations have implemented their own environmental regulations, reflecting varying levels of commitment and approaches to sustainability.

But how is Asia EU-ESG ready and how will the EU regulations impact companies in China, Indonesia, India, Vietnam and India?

Vietnam

With a burgeoning economy and a rapidly evolving industrial landscape, Vietnam finds itself at a critical juncture where balancing economic growth with environmental conservation, social equity, and robust governance is paramount. This article delves into Vietnam’s ESG regulatory framework, examining the country’s commitments towards sustainability.

From environmental protection laws to social welfare initiatives and corporate governance standards, Vietnam’s journey towards ESG integration offers valuable insights into the complexities of sustainability in emerging markets.

ESG Regulatory Framework in Vietnam

1. Environment

Since 2018, Vietnam and the EU have signed a voluntary partnership agreement to strengthen the enforcement of forestry laws, forest governance and forest product trade (VPA/FLEGT). It aimed to establish a legal framework to ensure that all wood products exported from Vietnam to the EU have legitimate origin and are produced legally.

Vietnam is an engaged member of the global community in forest conservation and development. Along with 140 countries, Vietnam joined the Glasgow Leaders’ Declaration on Forests and Land Use at the COP26 conference. This commitment aims to prevent and reverse deforestation by 2030.

Also, Vietnam has made significant strides in developing its environmental legal framework over the years in line with its National Strategy on Green Growth Period 2021 to 2030, with a Vision to 2050. The country aims to have net-zero carbon emissions by 2050. By 2030, together with more than 100 countries in COP26, Vietnam aims to stop deforestation and to majorly reduces Greenhouse Gas emissions. Also within the COP26 commitment, Vietnam also plans to phase out coal-fueled power generation by 2040. .

The cornerstone of environmental regulation is the Law No. 72/2020/QH14 on Environmental Protection (“EPL”), which came into force on 1 January 2022 and provides the applicable legal basis for environmental protection activities, pollution control, and management of natural resources.

Additionally, Vietnam has promulgated numerous decrees, circulars, and legal documents to supplement the EPL including regulations on specific environmental issues such as air and water quality management, waste management, biodiversity conservation, and climate change mitigation. Businesses operating in Vietnam are subject to a range of environmental obligations aimed at minimizing their environmental impact and promoting sustainable practices which are detailed in various legal documents and basis.

These obligations include obtaining environmental permits and approvals for certain activities, complying with emissions standards and pollution control measures, and implementing environmental management systems.

However, challenges remain, including inadequate enforcement of environmental regulations, limited public participation in decision-making processes, and the need for greater investment in pollution control technologies and infrastructure.

2. Social

Vietnam’s legal framework for social protection is underpinned by various laws, policies, and regulations aimed at promoting social welfare, economic stability, and human rights. The Constitution of Vietnam enshrines principles of social justice and equality, emphasizing the state’s responsibility to ensure the well-being of its citizens and lays the foundations for the fight against forced labour in Vietnam.

Key legislation includes the Labor Code 2019, Law on Social Insurance 2014, and the Law on Prevention and Combat of Human Trafficking 2011, which establish rights and obligations related to social security, employment, and social assistance programs.

Vietnam has taken proactive measures to combat forced labor, recognizing it as a grave violation of human rights and a threat to human dignity. Vietnam has undertaken National Action Programs against Trafficking since 2004.

Furthermore, Vietnam has strengthened its legal framework to address forced labor, with amendments to the Criminal Code imposing harsh penalties for human trafficking offenses, including forced labor exploitation. The government has also enhanced cooperation with international partners and law enforcement agencies to combat cross-border trafficking networks and protect victims of forced labor.

Since June 2020, Vietnam has been the signatory of the International Labor Organization’s Convention on Abolition of Forced Labor.

However, Vietnam’s efforts to combat human trafficking face significant challenges due to various shortcomings in existing measures. Key stakeholders, including law enforcement and rehabilitation center staff, lack adequate training, leading to misconduct cases. The absence of an evaluation framework impedes the assessment of anti-trafficking initiatives. Returnee victims struggle with societal stigma and insufficient government support in rebuilding their lives, particularly in financial, educational, and legal aspects.

3. Governance

Corporate governance in Vietnam is primarily governed by the Law on Enterprises 2020 and various related regulations issued by the government. The Law on Enterprises 2020 sets out the legal framework for the establishment, organization, operation, and dissolution of enterprises in Vietnam. It outlines the rights and obligations of shareholders, directors, and other stakeholders, aiming to promote transparency, fairness, and efficiency in corporate management.

The State Securities Commission (“SSC”) oversees corporate governance practices for public companies listed on the stock exchange. Public companies are required to comply with regulations issued by the SSC, including disclosure requirements and corporate governance standards set forth in the Corporate Governance Code.

In addition to corporate governance requirements, companies in Vietnam have reporting obligations to regulatory authorities, shareholders, and other stakeholders.

Since 2016, certain types of companies must include in their annual report sustainability performance-related disclosures, which shall include environment and social performance disclosures.. The company’s board of directors is also to provide an assessment report related to the company’s environmental and social responsibilities.

According to the Law on Securities 2019, public corporations, organisations that publicly offer corporate bonds, organisations that have corporate bonds listed, securities companies, fund management companies are required to submit their annual report.

Public companies listed on the stock exchange must also disclose quarterly and interim financial information to the SSC and shareholders. These reports provide updates on the company’s financial performance and operating activities between annual reporting periods.

Vietnam has made significant progress in enhancing corporate governance practices and reporting standards in recent years. The government has introduced reforms to improve transparency, strengthen investor protection, and align regulatory frameworks with international best practices.

However, challenges remain, including limited enforcement of corporate governance regulations, insufficient capacity of regulatory authorities, and the need for greater awareness and education among companies and stakeholders. Addressing these challenges will require continued collaboration between the government, business community, and civil society to foster a culture of corporate transparency and accountability.

2. Reception of EU regulations in Vietnam

The CSRD is expected to have a strong impact in Vietnam since in recent years, the bilateral trade turnover between the EU and Vietnam has seen positive developments, especially since the signature of the Vietnam-EU Free Trade Agreement making Vietnam the EU’s 16th largest trading partner and the EU’s largest trading partner among the ASEAN countries. The CSRD will require subsidiaries of European companies or companies within the value chain of European partners to initiate data collection and sustainability report compilation to provide to their European partners or parent companies upon request.

Although the implementation of the CBAM by the EU directly impacts key industries in Vietnam, such as iron and steel, cement, fertilizer, and aluminum, CBAM is seen by the Vietnamese press as a way to accelerate Vietnam’s effort for energy transition and carbon emission reduction. Vietnamese exporters must navigate the evolving scope of CBAM, which may expand to include indirect emissions and additional carbon-intensive sectors. To remain competitive in the EU and minimize the impact on production and export activities, Vietnamese exporters are urged to monitor CBAM progress closely, study reporting requirements for greenhouse gas emissions, assess financial implications, evaluate commercial opportunities for greener products, and implement decarbonization policies and greener production methods.

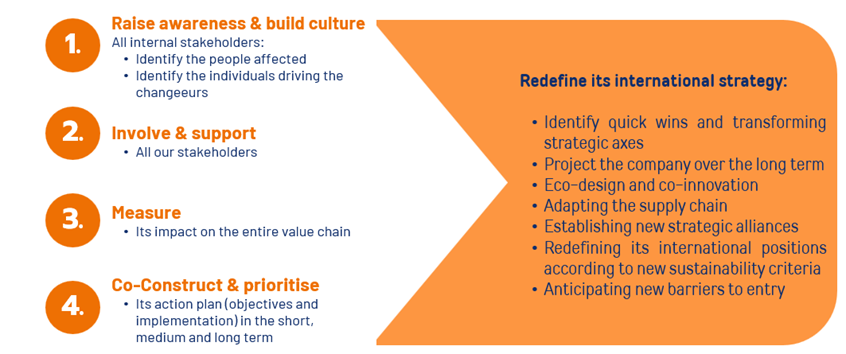

Impact of EU regulations on companies in Asia

The implementation of ESG principles and compliance with regulations can have a significant impact on companies operating in or trading with the EU. Companies must adapt to new standards and practices to maintain market access and competitiveness. This includes integrating sustainability goals into their operations, investing in cleaner technologies, and ensuring compliance with environmental and social regulations.

The CSRD will require subsidiaries of European companies or companies within the value chain of European partners to initiate data collection and sustainability report compilation to provide to their European partners or parent companies upon request.

Subsidiaries of European companies will benefit from available resources and a sustainability strategy that has been cascaded from the parent company whereas companies within the value chain of European businesses will need to carry out more preparatory work to meet requirements from their European partners to comply with the CSRD as they may lack guidance on European regulations. It is therefore paramount that companies educate themselves and seek guidance from their European partners to assess actions to be taken at their level to initiate data collection and sustainability report compilation.

Although the implementation of the CBAM by the EU directly impacts key industries, exporters must navigate the evolving scope of CBAM, which may expand to include indirect emissions and additional carbon-intensive sectors. To remain competitive in the EU and minimize the impact on production and export activities, exporters are urged to monitor CBAM progress closely, study reporting requirements for greenhouse gas emissions, assess financial implications, evaluate commercial opportunities for greener products, and implement decarbonization policies and greener production methods.

In addition to CBAM, exporters must comply with EU regulations on forced labor and deforestation to access the European market. The forced labor products ban requires rigorous due diligence to ensure no forced labor risks exist in the supply chain, including online sales. Similarly, exporters must provide evidence that their products have not contributed to deforestation or forest degradation. Exporters face the challenge of increased effort in tracking and tracing the origins of export goods, requiring training for all participants in the supply chain.

Companies that succeed in adapting to these changes can enhance their reputation and competitiveness in the global market. However, those that do not comply may face barriers to market entry and potential financial sanctions. The emphasis on sustainability and responsible business practices should drive innovation and create new opportunities for proactive companies facing environmental and social challenges.